Table of Contents

Background on the 3 Fund Portfolio

The 3 fund portfolio is a book that I am taking from the bogle heads forum. the name bogle heads refers to the investing enthusiasts that can be found on their website. However, the name itself is a reference to John “Jack” Bogle, the founder and chief executive of The Vanguard Group, and creator of the first index fund.

The basic idea of the three fund portfolio is to allocate your money between three major index funds, VTSAX, VBTLX, and VTIAX. The ratio you allocate to each fund changes based on market conditions and your personal risk tolerance. These funds are all owned by Vanguard. However, other brokerages will have the same types of funds, which I will cover in a different article.

VTSAX is my favorite investment vehicle. Whenever a friend or coworkers asks how to get started investing in stocks, the first piece of advice I will typically give is “put your money in VTSAX!” This is a pretty common piece of advice in the investing community. This advice is widespread because it’s good advice for investors just starting out. However, it doesn’t necessarily constitute a full investing strategy. This is especially true as your accounts start to grow. Let’s do an analysis to see where this advice holds merit and where it is lacking.

The Basics of VTSAX

First of all, VTSAX is a low cost ETF, with an expense ratio of 0.04%. This is good, considering the average expense ratio of a mutual fund is somewhere between 0.5 and 1%. VTSAX is well below average in this regard, but why should you care? Well, it means the owners of the fund aren’t bleeding us into the red by taking all of our profits from the stock market and paying it to themselves. We like when our fund managers aren’t greedy.

What actually is VTSAX though? VTSAX’s full name is Vanguard Total Stock Market Index Fund. This means that when the fund receives money from investors, it splits that money up and invests it into every stock that is publicly traded on the market, in proportion to the size/value of the company. (This is an overly simplified view but it gets the point across.)

Compared to picking individual stocks, this is generally a much better strategy. It diversifies the risk of the investor by not tying his or her success to the success of any one individual company. Instead, that risk is spread out across all companies. When the market does well as a whole the investor wins. When the market as a whole does poorly, so to does the investor. (HINT: in the long run the stock market always goes up.)

VTSAX/S&P500 Performance Over Time

VTSAX hasn’t been around forever, but the S&P500 has been for a good while, and closely tracks the total market fund (Correlation of ~0.99) so we will start our study there. First, lets look at annual return.

As you can see, the solid majority of years yield a positive return, so we’re looking good there. Clearly noticeable is the great depression in the 1930’s, and more recently, the dot com bust in the early 2000’s. On the right you can see the great recession, with the largest drop since the great depression in 1931. Those events really sucked, but when you look at the big picture, it’s mostly positive. As of the writing of this post, the average annual return since 1926 is 11.9%. That may not be true forever, but a rate of 9 or 10% not accounting inflation is a reasonably safe bet. So what does that look like when compounding?

Well, here you can see that if you put a dollar into the market in 1926, it would now be worth roughly $9,206, for a 920,600% rate of return. Pretty good huh? To be fair, a dollar in 1926 was worth $14.49 of today’s dollars due to inflation. This reduces our real rate of return by a good bit. It’s very clear though that investing in the market would give you much better results than, for example, a savings account that matches inflation. On the above graph it’s a bit hard to see any growth before 1980 due to the exponential growth, so just for fun, lets look at pre-1980 returns.

See? The gains were there the whole time. They were just dwarfed by the exponential effect on money that compounding returns has! These crazy gains are why a total market fund (or S&P500 fund) typically makes up the lion’s share of a 3 fund portfolio.

A Counter to Why You Shouldn’t Invest Solely in VTSAX

Diversification is Key

However, even though a person investing in VTSAX is way ahead of the average investor, they still haven’t truly “diversified.” Some would argue that investing in a total market fund is enough diversification for any one individual. After all, they’ve invested in every single stock the New York Stock Exchange has to offer. For those who are young and just starting out this might be true. If you already have an emergency fund, and you’re young with no fiscal responsibilities, then it makes sense to put all your money in domestic markets to maximize growth.

For the rest of us though, it’s a good idea to diversify even farther, which is how we get the 3 fund portfolio. The world is so much bigger than the US stock market! Enter the Vanguard Total Bond Market Fund (VBTLX) and the Vanguard Total International Stock Index Fund (VTIAX). These are the cousins of our VTSAX total market fund, but for other investment areas. Let’s dive in and see what we’re investing in.

The basics of VBTLX

VBTLX helps to diversify out of just stocks and into bonds. Bonds are another wonderful investment vehicle, and one that is much less volatile than stock. For those of you who don’t know much about bonds, these are basically loans from investors to large companies or the government, which in theory sounds a bit risky. However, these are what is called secured debt, which means there are tangible assets that the company can sell to repay the money owed if it has to. This is at odds with stocks. Stocks only get the left-overs after all secured debt is paid when a company goes bankrupt.

Investing in secured debt (bonds) doesn’t completely guarantee repayment, but it’s pretty darn close. Additionally, there are a bunch of levels to bonds which can be a bit complicated to understand. For the sake of keeping it simple though, the group of safest bonds are called “investment grade.” The less than desirable and riskier ones are called “junk bonds.” The VBTLX diversifies by investing across the whole market like VTSAX does for US stocks, but instead for the US “investment grade” bond market.

The basics of VTIAX

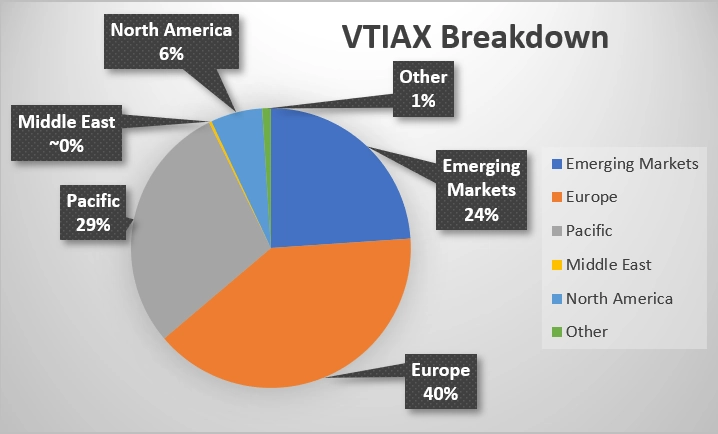

The VTIAX (unsurprisingly) also mirrors VTSAX by spreading out money across the entire market. The difference is that rather than using US companies, the stock is in international companies. If you’re curious as to where the money is going I’ve included a breakdown below. If you want to know what companies and why, I recommend checking out the prospectus available at Vanguard’s website.

Finding Balance Between Stocks and Bonds both International and Domestic

Typically, stocks and bonds are inversely correlated (though that isn’t always the case) and balance each other out well. In the same way, if the US companies aren’t doing well, one of two things are probably happening. Either businesses in other countries are doing really well and taking market share, in which case you’ll be happy you invested in VTIAX, or the entire world is experiencing a recession/depression, at which point you’ll be happy with the slow steady returns of VBTLX. If all three are tanking at the same time, something is seriously wrong with the world economy. In this case, you probably have bigger issues than your portfolio, like World War III or something.

That pretty much covers the basics of the 3 fund portfolio. I will be writing a follow up to this post talking about risk tolerance and how to choose allocations for these 3 funds. Yes, I know this article had a heavy focus on VTSAX, which was intentional. I am biased toward the high risk high reward route with my own time horizon, and most of my readership is young. If it interests readers, I will do a more in depth analysis of VTIAX and VBTLX in a subsequent post as well. Let me know if you would find this valuable in the comments!

*This article does not constitute investment advice, it purely reflects my personal opinions. I am not a CFP, invest at your own risk.

- The Importance of a Cash Cushion - August 25, 2021

- Money is Just a Game (Money Mindset) - August 14, 2021

- Low-Cost ETFs: An Explainer - August 8, 2021